Building Financial Resilience

Australian households are currently facing significant pressure on their budgets. Over the last two years, the real disposable income, which refers to income after taxes and interest payments adjusted for inflation, has decreased due to rising inflation, higher interest rates, and increased taxes. Recently, disposable incomes have begun to stabilise, returning to levels similar to those before the pandemic, thanks in part to tax cuts and declining inflation.

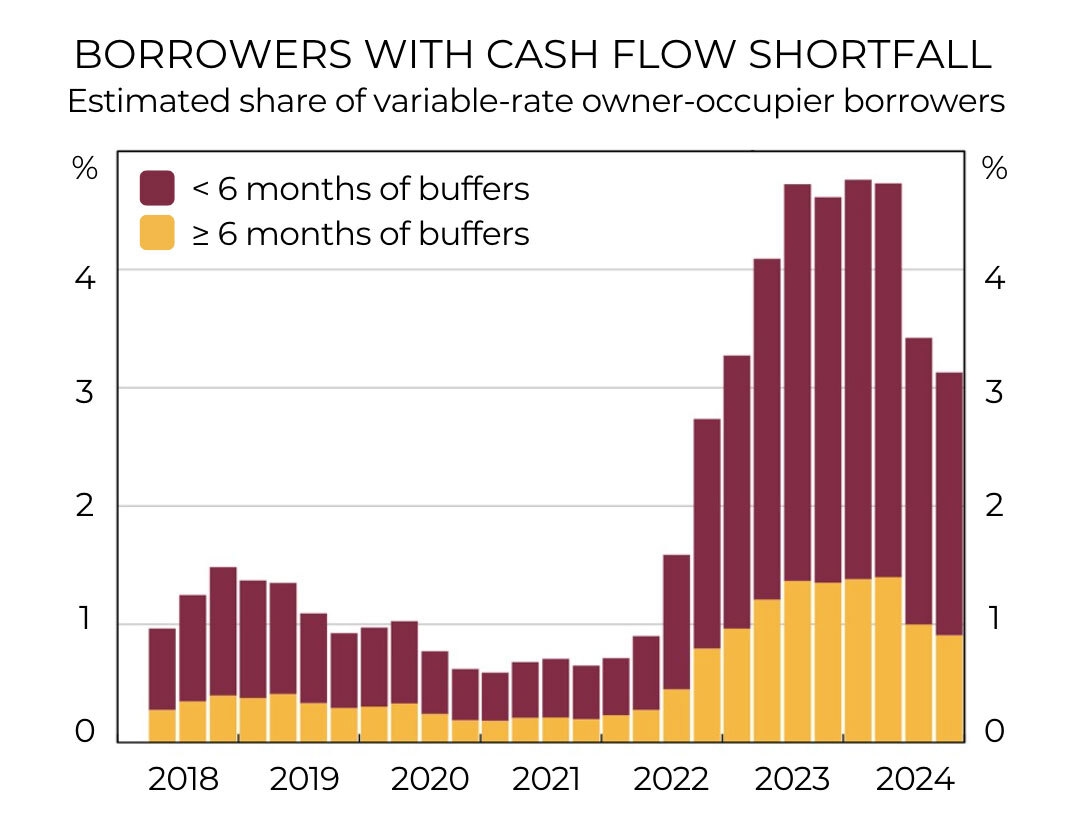

Despite these pressures, most borrowers are still able to meet their essential expenses and mortgage payments. Currently, about 3% of borrowers are experiencing a cash flow shortfall, which means they’re at risk of falling behind on payments. While this figure has risen since the pandemic, it remains lower than the peak seen before new tax cuts and improving inflation trends.

The likelihood of borrowers defaulting on their repayments is low. Most households are successfully managing their debts, and those experiencing severe financial stress are few and far between. The number of loans in arrears (more than three months overdue) has leveled off at pre-pandemic levels, and household insolvency rates are also low.

One reason for this stability is the strong job market, which allows people to maintain or find employment and potentially earn higher wages. Although there has been a slight softening in employment since late 2022, Australia’s employment rate is still quite high.

However, higher loan arrears rates are noted among heavily indebted households and those with lower incomes. Despite this, arrears rates for these groups have recently declined. Most borrowers have maintained solid financial buffers, helping them withstand pressures on their cash flows. Less than 1% of households are currently experiencing negative equity—where the value of their property is less than what they owe on their mortgage—signifying a notable improvement since prior to the pandemic.

Overall, the majority of borrowers are expected to manage their debts even in challenging economic conditions. In the event of a severe drop in property prices, around 90% of borrowers would still hold positive equity, allowing them to sell their homes if necessary.

Should you wish to review your position and consider your options, we’re only a call away.